Mohawk ESV, Inc. Health and

Welfare Benefit Plan

LOCALPLUS MEDICAL BENEFITS

Georgia Medical Neighborhood Copay Plan

EFFECTIVE DATE: January 1, 2022

ASO26

2500322, 2500325

This document printed in July, 2022 takes the place of any documents previously issued to you which

described your benefits.

Printed in U.S.A.

Table of Contents

Important Information ..................................................................................................................5

Important Notices ..........................................................................................................................3

Completing Your Health Assessment ..................................................................................................................... 3

2022 Medical Plan Spousal Surcharge ................................................................................................................... 3

Notice of Privacy Practices ............................................................................................................4

Special Plan Provisions ................................................................................................................12

Important Notices ........................................................................................................................13

How To File Your Claim .............................................................................................................15

Eligibility - Effective Date ...........................................................................................................16

Employee Coverage.............................................................................................................................................. 16

Waiting Period .................................................................................................................................................... 16

Dependent Coverage .......................................................................................................................................... 17

Important Information About Your Medical Plan ...................................................................17

LocalPlus Medical Benefits .........................................................................................................19

The Schedule ........................................................................................................................................................ 19

Certification Requirements - Out-of-Network ...................................................................................................... 44

Prior Authorization/Pre-Authorized ..................................................................................................................... 44

Covered Expenses ................................................................................................................................................ 45

Exclusions, Expenses Not Covered and General Limitations ..................................................55

Coordination of Benefits..............................................................................................................57

Expenses For Which A Third Party May Be Responsible .......................................................59

Payment of Benefits .....................................................................................................................60

Termination of Plan Coverage ....................................................................................................61

Employees ............................................................................................................................................................ 61

Dependents ........................................................................................................................................................... 61

Rescissions ........................................................................................................................................................... 62

Medical Benefits Extension During Hospital Confinement .....................................................62

Federal Requirements .................................................................................................................62

Notice of Provider Directory/Networks................................................................................................................ 63

Continuity of Care When Provider Moves Out of Network ................................................................................. 63

Qualified Medical Child Support Order (QMCSO) ............................................................................................. 63

Special Enrollment Rights Under the Health Insurance Portability & Accountability Act (HIPAA) .................. 64

Effect of Section 125 Tax Regulations on This Plan ............................................................................................ 65

Eligibility for Coverage for Adopted Children ..................................................................................................... 66

Coverage for Maternity Hospital Stay .................................................................................................................. 66

Women’s Health and Cancer Rights Act (WHCRA) ........................................................................................... 66

Group Plan Coverage Instead of Medicaid ........................................................................................................... 66

Requirements of Family and Medical Leave Act of 1993 (as amended) (FMLA) ............................................... 67

Uniformed Services Employment and Re-Employment Rights Act of 1994 (USERRA) .................................... 67

Claim Determination Procedures under ERISA ................................................................................................... 67

Appointment of Authorized Representative ......................................................................................................... 69

Medical - When You Have a Complaint or an Appeal ......................................................................................... 69

COBRA Continuation Rights Under Federal Law ............................................................................................... 71

ERISA Required Information ............................................................................................................................... 74

Definitions .....................................................................................................................................76

Important Information

THIS IS NOT AN INSURED BENEFIT PLAN. THE BENEFITS DESCRIBED IN THIS BOOKLET OR

ANY RIDER ATTACHED HERETO ARE SELF-INSURED BY MOHAWK ESV, INC. WHICH IS

RESPONSIBLE FOR THEIR PAYMENT. CIGNA HEALTH AND LIFE INSURANCE COMPANY

(CIGNA) PROVIDES CLAIM ADMINISTRATION SERVICES TO THE PLAN, BUT CIGNA DOES NOT

INSURE THE BENEFITS DESCRIBED.

THIS DOCUMENT MAY USE WORDS THAT DESCRIBE A PLAN INSURED BY CIGNA. BECAUSE

THE PLAN IS NOT INSURED BY CIGNA, ALL REFERENCES TO INSURANCE SHALL BE READ TO

INDICATE THAT THE PLAN IS SELF-INSURED. FOR EXAMPLE, REFERENCES TO "POLICY"

SHALL BE DEEMED TO MEAN "PLAN” AND "INSURED" TO MEAN "COVERED" AND

"INSURANCE" SHALL BE DEEMED TO MEAN "COVERAGE."

HC-NOT89MF

Important Notices

Completing Your Health Assessment

Mohawk encourages employees and their spouses to make healthy lifestyle choices. As part of our wellness

initiative, we encourage you and your spouse, if you are going to enroll in the Mohawk medical benefit

program, to complete your biometric screening. This allows you to focus on your health and save money while

doing so!

It is your choice whether you participate in the biometric screening or not. However, if you and your covered

spouse complete the biometric screening and meet the recommended biometric standards (as outlined in your

benefits enrollment materials), you will avoid having to pay the wellness surcharge. The wellness surcharge is

an additional $28.85 per week (or $125 per month) for both you and your spouse on top of your regular

contributions for medical coverage (for a maximum surcharge of $57.70 per week, or $250 per month).

If you and your covered spouse complete the biometric screening but do not meet the recommended biometric

standards, you can still avoid the wellness surcharge by engaging in healthy lifestyle support via face-to-face,

telephonic, or online learning. Alternatively, you can work with your personal physician on a wellness plan.

You will have a total of 60 days to complete your biometric screening after your benefit effective date. If you

miss the deadline or choose not to complete this, your medical coverage contribution amount for both you and

your covered spouse will increase by $125 per month ($28.85 per week).

You may complete a biometric screening at NO COST to you at ONE of the following:

at a Healthy Life Center in your area. Before calling, visit WWW.MYMOHAWKBENEFITS.COM to see

if a Healthy Life Center is located near you, and to locate the number for your Healthy Life Center.

at a Quest Diagnostics facility in your area. To locate a Quest Diagnostics facility near you, visit

www.my.blueprintforwellness.com. To schedule an appointment at a Quest facility, call 1-866-908-9440.

For participants asked to do a re-test, visit the www.mymohawkbenefits.com website for the current keycode.

Mohawk is committed to helping you achieve your best health. All employees can avoid the wellness surcharge

by participating in the wellness program described above. If you think you might be unable to meet a standard

for avoiding the wellness surcharge under this wellness program, you might qualify for an opportunity to avoid

the wellness surcharge by different means. Contact the Benefits Service Center at 1-866-481-4922 and we will

work with you (and, if you wish, with your physician) to find a wellness program with the same reward that is

right for you in light of your health status.

2022 Medical Plan Spousal Surcharge

If your spouse is eligible for medical benefits through another employer and chooses to remain on the Mohawk

medical benefit program, your spouse will be subject to a $125 surcharge each month ($28.85 per week).

You will receive a communication in the mail from Alight approximately 6 weeks after your benefits effective

date. Alight will be conducting an audit of dependent enrollments, and you will be asked to provide

documentation (birth certificate, marriage certificate, etc.). If you enroll a spouse in the Mohawk medical

benefit program, then he or she will be included in a spousal audit for other medical coverage. If your spouse’s

company offers insurance and you elect to cover him or her on Mohawk’s medical benefit program, you will

pay an additional $125 per month ($28.85 per week) in medical contributions. Alight can be contacted at 1-877-

308-9157. Failure to provide the proper documentation in a timely manner will result in benefit termination for

your dependent. Furthermore, submission of fraudulent documentation could result in disciplinary action up to

and including termination. A Mohawk employee currently married to another Mohawk employee can stay on

their current plan with no surcharge.

Effective Date: January 1, 2022

MOHAWK ESV, INC. HEALTH AND WELFARE BENEFIT PLAN

Notice of Privacy Practices

THIS NOTICE DESCRIBES HOW MEDICAL INFORMATION ABOUT YOU MAY BE USED AND

DISCLOSED AND HOW YOU CAN GET ACCESS TO THIS INFORMATION. PLEASE REVIEW IT

CAREFULLY.

If you have any questions about this Notice, please contact Mohawk’s privacy official, the Privacy Officer, who

can be contacted at Mohawk Industries, 160 South Industrial Boulevard, Calhoun, GA 30701, or by phone at

(866) 481-4922.

Who Will Follow This Notice

This Notice describes the medical privacy practices of the self-funded group health benefit programs offered

under the Mohawk ESV, Inc. Health and Welfare Benefit Plan (the “Plan”). We are giving you this Notice to

inform you of these rights and to comply with a federal law called the Health Insurance Portability and

Accountability Act of 1996. This law is also known as “HIPAA.”

Our Pledge Regarding Medical Information

We understand that medical information about you and your health is personal, and we are committed to

protecting that information. As part of that protection, we have created a record of your health care claims under

the Plan. This Notice applies to all of the medical records the Plan maintains about you. Your personal doctor or

personal health care provider may have different policies or notices regarding the uses and disclosures of your

medical information which may have been created by that doctor or health care provider. In addition, some

health benefits are provided through insurance where Mohawk does not have access to protected health

information. If you are enrolled in any insured group health benefit program sponsored by Mohawk, you will

receive a separate privacy notice from the insurer. Please note that the group health benefit programs offered

under the Mohawk ESV, Inc. Health and Welfare Benefit Plan are part of an organized health care arrangement

because they are all sponsored by Mohawk. This means that the benefit programs may share your protected

health information with each other, as needed, for the purposes of payment and health care operations.

This Notice tells you about the ways in which the Plan may use or disclose medical information about you. It

also describes the Plan’s privacy obligations to you and your rights regarding the use and disclosure of your

medical information.

The Plan is required by HIPAA to:

make sure that medical information that identifies you is kept private;

give you this Notice of its legal duties and privacy practices with respect to medical information about you;

and

follow the terms of this Notice until it is changed. If it is changed, you will receive a copy of the new Notice

as long as the Plan keeps personalized health information about you.

In addition to HIPAA, special protections under state or other federal laws may apply to the use and disclosure

of your protected health information. The Plan will comply with these state or federal laws where they are more

protective of your privacy, but only to the extent these laws are not superseded by federal preemption.

How the Plan May Use and Disclose Medical Information About You

The following categories describe different ways that the Plan uses and discloses medical information about

you. For each category of uses or disclosures, we will explain what we mean and present some examples.

Obviously, we cannot list every possible use or disclosure which exists, but we will try to list the important

ones. All of the ways the Plan is permitted to use and disclose information will fall within one of the categories.

Your Treatment. The first way the Plan may use or disclose medical information about you is to help you with

medical treatment or services. The Plan may disclose medical information about you to providers, including

doctors, nurses, technicians, medical students, or other hospital personnel who are involved in taking care of

you. For example, the Plan might disclose information about your prior prescriptions to a pharmacist to

determine if a new prescription could cause health problems because it conflicts with prior prescriptions.

Payment of Your Claims. The Plan may use or disclose medical information about you to determine if you are

eligible for Plan benefits, to pay for treatment or services you receive from health care providers, to determine

benefit responsibility under the Plan, or to coordinate Plan coverage with other plans. For example, the Plan

may tell your health care providers about your medical history to determine if a particular treatment is

experimental, investigational, or medically necessary, or to determine if the Plan will cover the treatment. The

Plan may also share medical information with a utilization review or precertification service provider. In

addition, the Plan may share medical information with another organization to help determine if a claim should

be paid or if another person or Plan should be responsible for the claim.

Health Care Operations. The Plan may use or disclose medical information about you for other Plan health

care operations. These uses and disclosures are necessary to run the Plan. For example, the Plan may use

medical information to conduct quality assessment or improvement activities; to determine the cost of

premiums or conduct activities relating to Plan coverage; to submit claims for stop-loss coverage; to conduct or

arrange for medical review, legal services, audit services, or fraud and abuse detection programs; and to predict

the cost of future claims or manage costs. The Plan’s health care operations also include case management and

coordination of care, for example, in connection with the Plan’s wellness or disease management programs.

However, federal law prohibits the Plan from using or disclosing protected health information that is genetic

information (e.g., family medical history) for underwriting purposes, which include eligibility determinations,

calculating premiums, and any other activities related to the creation, renewal, or replacement of a health

insurance contract or health benefits.

Business Associates. The Plan may hire third parties that may need your medical information to perform

certain services on behalf of the Plan. These third parties are “Business Associates” of the Plan. Business

Associates must protect any protected health information they receive from, or create and maintain on behalf of,

the Plan. For example, the Plan may hire a third-party administrator to process claims, an auditor to review how

an insurer or third-party administrator is processing claims, or an insurance agent to assess coverages and help

with claim problems. In addition to performing services for the Plan, Business Associates may use protected

health information for their own management and legal responsibilities and for purposes of aggregating data for

Plan health care operations.

Health Information Exchange. As permitted by law, the Plan may participate in Health Information

Exchanges (“HIEs”) to provide or receive medical information for activities described in this Notice (i.e.,

treatment, payment, and health care operations purposes). HIEs are organizations where participating health

care providers or other health care entities can provide or receive information from each other related to your

care.

As Required By Law. The Plan will disclose medical information about you when required to do so by federal,

state or local law. For example, the Plan may disclose medical information when required by a court order in a

lawsuit such as a malpractice action.

To Avert a Serious Threat to Health or Safety. The Plan may use or disclose medical information about you

when necessary to prevent a serious threat to your health or safety, or to the health and safety of the public or

another person. Any disclosure, however, would only be to someone able to help prevent the threat. For

example, the Plan may disclose medical information about you in a proceeding concerning the license of a

doctor or nurse.

Special Situations

Disclosure to Mohawk or other Mohawk Plans. Your health information may be disclosed to another health

benefit program maintained by Mohawk for purposes of paying claims under that benefit program. In addition,

medical information may be disclosed to certain designated Mohawk employees who are responsible for

administering the Plan to help you with a claim or to administer benefits under the Plan, such as to determine a

claims appeal. The Plan may also disclose information to Mohawk that summarizes the claims experience of

Plan participants as a group, but without identifying specific individuals, to get new benefit insurance or to

change or terminate the Plan. For example, if Mohawk wants to consider adding or changing organ transplant

benefits, it may receive this summary health information to assess the cost of those services. The Plan may also

disclose limited health information to Mohawk in connection with the enrollment or disenrollment of

individuals into or out of the Plan.

Disclosures to Provide You With Information. The Plan or its agents may contact you to remind you about

appointments or provide information about treatment alternatives or other health-related benefits and services

that may be of interest to you.

Organ and Tissue Donation. If you are an organ donor, the Plan may release your medical information to

organizations that handle organ procurement or organ, eye or tissue transplants, or to an organ donation bank to

help with organ or tissue donation.

Military and Veterans. If you are a member of the armed forces, the Plan may release medical information

about you as required by the military. The Plan may also release medical information about foreign military

personnel to the appropriate foreign military authority.

Workers’ Compensation. The Plan may release medical information about you for workers’ compensation or

similar programs. These programs provide benefits for work-related injuries or illness.

Public Health Risks. The Plan may disclose medical information about you for public health purposes. This

includes disclosures:

to prevent or control disease, injury or disability;

to report births and deaths;

to report child abuse or neglect;

to report reactions to medications or problems with products;

to notify people of recalls of products they may be using;

to notify a person who may have been exposed to a disease or may be at risk for contracting or spreading

a disease or condition;

to notify the appropriate government authority if the Plan believes a patient has been the victim of abuse,

neglect or domestic violence. The Plan will only make this disclosure if you agree or if required or

authorized by law.

Health Oversight Activities. The Plan may disclose medical information to a government health agency for

activities authorized by law. These activities include, for example, audits, investigations, inspections, and

licensing. These activities are necessary for the government to monitor the health care system, government

programs, and to comply with civil rights laws.

Lawsuits and Disputes. If you are involved in a lawsuit or a dispute, the Plan may disclose medical

information about you in response to a court or administrative order. The Plan may also disclose medical

information about you in response to a subpoena, discovery request, or other lawful demand by someone else

involved in the dispute, but only if efforts have been made to tell you about the request or to obtain an order

protecting the information requested.

Law Enforcement. The Plan may release medical information if asked to do so by a law enforcement official:

in response to a court order, subpoena, warrant, summons or similar court papers;

to identify or locate a suspect, fugitive, material witness, or missing person;

about the victim of a crime even if, under certain limited circumstances, the Plan is unable to obtain

your agreement;

about a death the Plan believes may be the result of criminal conduct;

about criminal conduct at a hospital; or

in emergency circumstances to report a crime or the location of a crime or crime victims; or the

identity, description or location of the person who committed the crime.

Coroners, Medical Examiners and Funeral Directors. The Plan may release medical information to a

coroner or medical examiner. This may be necessary, for example, to identify someone who has died or to

determine the cause of death. The Plan may also release medical information about individuals to funeral

directors as necessary to carry out their duties.

National Security and Intelligence Activities. The Plan may release medical information about you to

authorized federal officials for intelligence, counterintelligence, and other security activities authorized by law.

Inmates. If you are an inmate of a correctional institution or under the custody of a law enforcement official,

the Plan may release medical information about you to the correctional institution or law enforcement official.

This release may be necessary (1) for the institution to provide you with health care; (2) to protect your health

and safety or the health and safety of others; or (3) for the safety and security of the correctional institution.

Your Rights Regarding Medical Information About You

You have the following rights regarding medical information the Plan maintains about you:

Right to Inspect and Copy. You have the right to inspect and copy medical information that may be used to

make decisions about your Plan benefits. To do so, you must submit your request in writing to Mohawk

Industries, 160 South Industrial Boulevard, Calhoun, GA 30701.

The Plan may deny your request to inspect and copy your information in certain circumstances. In most cases, if

you are denied access to medical information, you may request that the denial be reviewed.

Right to Amend. If you feel that medical information the Plan has about you is incorrect or incomplete, you

may ask the Plan to amend the information. You have the right to request an amendment of your information as

long as the information is kept by or for the Plan.

To request an amendment, your request must be made in writing and submitted to Mohawk Industries, 160

South Industrial Boulevard, Calhoun, GA 30701. In addition, you must provide a reason that supports your

request.

The Plan may deny your request for an amendment if it is not in writing or does not include a reason to support

the request. In addition, the Plan may deny your request if you ask to amend information that:

is not part of the medical information kept by or for the Plan;

was not created by the Plan, unless the person or entity that created the information is no longer

available to make the amendment;

is not part of the information which you would be permitted to inspect and copy; or

is accurate and complete.

Right to an Accounting of Disclosures. You have the right to request an accounting of the prior disclosures of

your health information if the disclosure was made for any purpose other than treatment, payment, or health

care operations.

To request this list or accounting of disclosures, you must submit your request in writing to Mohawk Industries,

160 South Industrial Boulevard, Calhoun, GA 30701. Your request must state a time period which may not be

longer than six years. Your request should indicate in what form you want the list (for example, paper or

electronic). The first list you request within a 12-month period will be free. For additional lists, the Plan may

charge you for the costs of providing the list. The Plan will notify you of the cost involved, and you may choose

to withdraw or modify your request at that time before any costs are incurred.

Right to Request Restrictions. You have the right to request a restriction or limitation on medical information

the Plan uses or discloses about you for treatment, payment or health care operations. You also have the right to

request a limit on the medical information the Plan discloses about you to someone who is involved in your care

or the payment for your care, such as a family member or friend. For example, you could ask that the Plan not

use or disclose information about a surgery you had. Effective February 18, 2010, provided you paid out-of-

pocket in full for the services received, we will honor any request you make to restrict information about those

services from the Plan provided that such release is not necessary for your treatment. In all other circumstances,

the Plan is not required to agree to your request.

To request restrictions, you must make your request in writing to Mohawk Industries, 160 South Industrial

Boulevard, Calhoun, GA 30701. In your request, you must tell the Plan (1) what information you want to limit;

(2) whether you want to limit the Plan’s use or disclosure of this information, or both; and (3) to whom you

want the restriction to apply, for example, you don’t want information disclosed to your spouse.

Right to Request Confidential Communications. You have the right to request that the Plan communicate

with you about medical matters in a certain way or at a certain location. For example, you can ask that the Plan

only contact you at work or by mail.

To request confidential communications, you must make your request in writing to Mohawk Industries, 160

South Industrial Boulevard, Calhoun, GA 30701. The Plan will not ask you the reason for your request, and will

accommodate all reasonable requests. Your request must specify how or where you wish to be contacted.

Right to a Paper Copy of This Notice. You have the right to a paper copy of this Notice. You may ask the

Plan to give you a copy of this Notice at any time. Even if you have agreed to receive this Notice electronically,

you are still entitled to a paper copy of this Notice. To obtain a paper copy of this Notice, contact the Privacy

Officer, Mohawk Industries, 160 South Industrial Boulevard, Calhoun, GA 30701.

Right to Receive Notification. You have a right to receive notification of a breach of your unsecured protected

health information.

Medical Information Not Covered by This Notice

This Notice does not cover (1) health information that does not identify you and with respect to which there is

no reasonable basis to believe that the information could be used to identify you; or (2) health information that

Mohawk can have under applicable law (e.g., the Family and Medical Leave Act, the Americans with

Disabilities Act, workers’ compensation laws, federal and state occupational health and safety laws, and other

state and federal laws), or that Mohawk properly can get for employment-related purposes through sources

other than the Plan and that is kept as part of your employment records (e.g., pre-employment physicals, drug

testing, fitness for duty examinations, etc.).

Changes to This Notice

The Plan reserves the right to change this Notice in the future, and to make the revised or changed Notice

effective for medical information the Plan already has about you as well as any information it receives in the

future. You will receive a copy of the changed Notice in the same manner that you received this Notice. The

Notice will contain the effective date on the first page in the top right-hand corner.

Complaints

If you believe your privacy rights have been violated, you may file a complaint with the Plan or with the

Secretary of the United States Department of Health and Human Services. To file a complaint with the Plan,

contact the Privacy Officer, Mohawk Industries, 160 South Industrial Boulevard, Calhoun, GA 30701. All

complaints must be submitted in writing. You will not be retaliated against for filing a complaint.

Other Uses of Medical Information

Other uses and disclosures of medical information not covered by this Notice or the laws that apply to the Plan

will be made only with your written permission. This written permission is called an “Authorization.” For

example, in general and subject to specific conditions, the Plan will not use or disclose psychiatric notes about

you; will not use or disclose your protected health information for marketing; and will not sell your protected

health information. If you provide the Plan with an Authorization to use or disclose medical information about

you, you may revoke that Authorization, in writing, at any time. If you revoke your Authorization, the Plan will

no longer use or disclose medical information about you for the reasons covered by your written Authorization.

You understand that the Plan is unable to take back any disclosures it has already made with your

Authorization, and that the Plan is required by law to retain records of the care that it has provided to you.

Introduction

Mohawk ESV, Inc. and its participating affiliates (together, the “Employer”) maintain the Mohawk ESV, Inc. Health and Welfare

Benefit Plan for the benefit of eligible employees and their family members. This document, which is also referred to in this document

as the “booklet,” is intended to serve as the booklet summary plan description (“SPD”) for the Open Access Plus Health Savings

Account medical and prescription drug benefit program offered under the Mohawk ESV, Inc.

Health and Welfare Benefit Plan (referred to in this booklet as the “Plan”).

This booklet describes the Plan as in effect on January 1, 2022. Please read this booklet carefully and keep it for future reference. If

you have any questions about the Plan, please contact Cigna, the claims administrator for the medical benefits provided under the

Plan, or Express Scripts, the claims administrator for the prescription drug benefits provided under the Plan, using the toll-free number

shown on the back of your ID card. For questions about the Plan’s coverage of specialty medications, please contact VIVIO, the

claims administrator for the specialty prescription drug benefits provided under the Plan, by phone at 800-470-4034 or via email at

[email protected]m. You may also log onto mymohawkbenefits.com or contact the Benefits Service Center at 1-866-481-4922.

Explanation of Terms

You will find terms starting with capital letters throughout this booklet. To help you understand your benefits, most of these terms are

defined in the Definitions section of the booklet.

The Schedule

The Schedule is a brief outline of your maximum benefits which may be payable under the Plan. For a full description of each

benefit, refer to the appropriate section listed in the Table of Contents.

myCigna.com

12

Special Plan Provisions

When you select a Participating Provider, this Plan pays a

greater share of the costs than if you select a non-Participating

Provider. Participating Providers include Physicians, Hospitals

and Other Health Professionals and Other Health Care

Facilities. Consult your Physician Guide for a list of

Participating Providers in your area. Participating Providers

are committed to providing you and your Dependents

appropriate care while lowering medical costs.

Services Available in Conjunction With Your Medical

Plan

The following pages describe helpful services available in

conjunction with your medical plan. You can access these

services by calling the toll-free number shown on the back of

your ID card.

HC-SPP70 01-21

Case Management

Case Management is a service provided through a Review

Organization, which assists individuals with treatment needs

that extend beyond the acute care setting. The goal of Case

Management is to ensure that patients receive appropriate care

in the most effective setting possible whether at home, as an

outpatient, or an inpatient in a Hospital or specialized facility.

Should the need for Case Management arise, a Case

Management professional will work closely with the patient,

his or her family and the attending Physician to determine

appropriate treatment options which will best meet the

patient's needs and keep costs manageable. The Case Manager

will help coordinate the treatment program and arrange for

necessary resources. Case Managers are also available to

answer questions and provide ongoing support for the family

in times of medical crisis.

Case Managers are Registered Nurses (RNs) and other

credentialed health care professionals, each trained in a

clinical specialty area such as trauma, high risk pregnancy and

neonates, oncology, mental health, rehabilitation or general

medicine and surgery. A Case Manager trained in the

appropriate clinical specialty area will be assigned to you or

your dependent. In addition, Case Managers are supported by

a panel of Physician advisors who offer guidance on up-to-

date treatment programs and medical technology. While the

Case Manager recommends alternate treatment programs and

helps coordinate needed resources, the patient's attending

Physician remains responsible for the actual medical care.

You, your dependent or an attending Physician can request

Case Management services by calling the toll-free number

shown on your ID card during normal business hours,

Monday through Friday. In addition, your employer, a claim

office or a utilization review program (see the PAC/CSR

section of your certificate) may refer an individual for Case

Management.

The Review Organization assesses each case to determine

whether Case Management is appropriate.

You or your Dependent is contacted by an assigned Case

Manager who explains in detail how the program works.

Participation in the program is voluntary - no penalty or

benefit reduction is imposed if you do not wish to

participate in Case Management.

Following an initial assessment, the Case Manager works

with you, your family and Physician to determine the needs

of the patient and to identify what alternate treatment

programs are available (for example, in-home medical care

in lieu of an extended Hospital convalescence). You are not

penalized if the alternate treatment program is not followed.

The Case Manager arranges for alternate treatment services

and supplies, as needed (for example, nursing services or a

Hospital bed and other Durable Medical Equipment for the

home).

The Case Manager also acts as a liaison between the Plan,

the patient, his or her family and Physician as needed (for

example, by helping you to understand a complex medical

diagnosis or treatment plan).

Once the alternate treatment program is in place, the Case

Manager continues to manage the case to ensure the

treatment program remains appropriate to the patient's

needs.

While participation in Case Management is strictly voluntary,

Case Management professionals can offer quality, cost-

effective treatment alternatives, as well as provide assistance

in obtaining needed medical resources and ongoing family

support in a time of need.

HC-SPP2 04-10

V1 M

Additional Programs

Cigna may, from time to time, offer or arrange for various

entities to offer discounts, benefits, or other consideration to

Plan participants for the purpose of promoting the general

health and well being of participants. Cigna may also arrange

for the reimbursement of all or a portion of the cost of services

myCigna.com

13

provided by other parties to the Employer. Contact us for

details regarding any such arrangements.

HC-SPP3 04-10

V1 M

Care Management and Care Coordination Services

Your plan may enter into specific collaborative arrangements

with health care professionals committed to improving quality

care, patient satisfaction and affordability. Through these

collaborative arrangements, health care professionals commit

to proactively providing participants with certain care

management and care coordination services to facilitate

achievement of these goals. Reimbursement is provided at

100% for these services when rendered by designated health

care professionals in these collaborative arrangements.

HC-SPP27 06-15

V1

Important Notices

Direct Access to Obstetricians and Gynecologists

You do not need prior authorization from the Plan or from any

other person (including a primary care provider) in order to

obtain access to obstetrical or gynecological care from a health

care professional in Cigna's network who specializes in

obstetrics or gynecology. The health care professional,

however, may be required to comply with certain procedures,

including obtaining prior authorization for certain services,

following a pre-approved treatment plan, or procedures for

making referrals. For a list of participating health care

professionals who specialize in obstetrics or gynecology, visit

www.mycigna.com or contact customer service at the phone

number listed on the back of your ID card.

Selection of a Primary Care Provider

This Plan generally allows the designation of a primary care

provider. You have the right to designate any primary care

provider who participates in the network and who is available

to accept you or your family members. For information on

how to select a primary care provider, and for a list of the

participating primary care providers, visit www.mycigna.com

or contact customer service at the phone number listed on the

back of your ID card.

For children, you may designate a pediatrician as the primary

care provider.

HC-NOT5 M 01-11

Important Information

Rebates and Other Payments

Cigna or its affiliates may receive rebates or other

remuneration from pharmaceutical manufacturers in

connection with certain Medical Pharmaceuticals covered

under the Plan. These rebates or remuneration are not obtained

on you or your Employer’s or plan’s behalf or for your

benefit. Cigna, its affiliates and the plan are not obligated to

pass these rebates on to you, or apply them to your plan’s

Deductible if any or take them into account in determining

your Copayments and/or Coinsurance.

Cigna and its affiliates or designees, conduct business with

various pharmaceutical manufacturers separate and apart from

this plan’s Medical Pharmaceutical benefits. Such business

may include, but is not limited to, data collection, consulting,

educational grants and research. Amounts received from

pharmaceutical manufacturers pursuant to such arrangements

are not related to this plan. Cigna and its affiliates are not

required to pass on to you, and do not pass on to you, such

amounts.

Coupons, Incentives and Other Communications

At various times, Cigna or its designee may send mailings to

you or your Dependents or to your Physician that

communicate a variety of messages, including information

about Medical Pharmaceuticals. These mailings may contain

coupons or offers from pharmaceutical manufacturers that

enable you or your Dependents, at your discretion, to purchase

the described Medical Pharmaceutical at a discount or to

obtain it at no charge. Pharmaceutical manufacturers may pay

for and/or provide the content for these mailings. Cigna, its

affiliates and the Plan are not responsible in any way for any

decision you make in connection with any coupon, incentive,

or other offer you may receive from a pharmaceutical

manufacturer or Physician.

HC-IMP304 M 01-22

Discrimination is Against the Law

Cigna complies with applicable Federal civil rights laws and

does not discriminate on the basis of race, color, national

origin, age, disability or sex. Cigna does not exclude people or

treat them differently because of race, color, national origin,

age, disability or sex.

Cigna:

Provides free aids and services to people with disabilities to

communicate effectively with us, such as:

Qualified sign language interpreters

Written information in other formats (large print, audio,

accessible electronic formats, other formats)

myCigna.com

14

Provides free language services to people whose primary

language is not English, such as

Qualified interpreters

Information written in other languages

If you need these services, contact customer service at the toll-

free phone number shown on your ID card, and ask a

Customer Service Associate for assistance.

If you believe that Cigna has failed to provide these services

or discriminated in another way on the basis of race, color,

national origin, age, disability or sex, you can file a grievance

by sending an email to ACAG[email protected] or by

writing to the following address:

Cigna

Nondiscrimination Complaint Coordinator

P.O. Box 188016

Chattanooga, TN 37422

If you need assistance filing a written grievance, please call

the number on the back of your ID card or send an email to

ACAGrievance@cigna.com. You can also file a civil rights

complaint with the U.S. Department of Health and Human

Services, Office for Civil Rights electronically through the

Office for Civil Rights Complaint Portal, available at:

https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or

phone at:

U.S. Department of Health and Human Services

200 Independence Avenue, SW

Room 509F, HHH Building

Washington, D.C. 20201

1-800-368-1019, 800-537-7697 (TDD)

Complaint forms are available at

http://www.hhs.gov/ocr/office/file/index.html.

HC-NOT96 07-17

Proficiency of Language Assistance Services

English – ATTENTION: Language assistance services, free

of charge, are available to you. For current Cigna customers,

call the number on the back of your ID card. Otherwise, call

1.800.244.6224 (TTY: Dial 711).

Spanish – ATENCIÓN: Hay servicios de asistencia de

idiomas, sin cargo, a su disposición. Si es un cliente actual de

Cigna, llame al número que figura en el reverso de su tarjeta

de identificación. Si no lo es, llame al 1.800.244.6224 (los

usuarios de TTY deben llamar al 711).

Chinese – 注意:我們可為您免費提供語言協助服務。

對於 Cigna 的現有客戶,請致電您的 ID 卡背面的號碼。

其他客戶請致電 1.800.244.6224 (聽障專線:請撥 711)。

Vietnamese – XIN LƯU Ý: Quý vị được cấp dịch vụ trợ giúp

về ngôn ngữ miễn phí. Dành cho khách hàng hiện tại của

Cigna, vui lòng gọi số ở mặt sau thẻ Hội viên. Các trường hợp

khác xin gọi số 1.800.244.6224 (TTY: Quay số 711).

Korean – 주의: 한국어를 사용하시는 경우, 언어 지원

서비스를 무료로 이용하실 수 있습니다. 현재 Cigna

가입자님들께서는 ID 카드 뒷면에 있는 전화번호로

연락해주십시오. 기타 다른 경우에는 1.800.244.6224

(TTY: 다이얼 711)번으로 전화해주십시오.

Tagalog – PAUNAWA: Makakakuha ka ng mga serbisyo sa

tulong sa wika nang libre. Para sa mga kasalukuyang customer

ng Cigna, tawagan ang numero sa likuran ng iyong ID card. O

kaya, tumawag sa 1.800.244.6224 (TTY: I-dial ang 711).

Russian – ВНИМАНИЕ: вам могут предоставить

бесплатные услуги перевода. Если вы уже участвуете в

плане Cigna, позвоните по номеру, указанному на

обратной стороне вашей идентификационной карточки

участника плана. Если вы не являетесь участником одного

из наших планов, позвоните по номеру 1.800.244.6224

(TTY: 711).

French Creole – ATANSYON: Gen sèvis èd nan lang ki

disponib gratis pou ou. Pou kliyan Cigna yo, rele nimewo ki

dèyè kat ID ou. Sinon, rele nimewo 1.800.244.6224

(TTY: Rele 711).

French – ATTENTION: Des services d’aide linguistique vous

sont proposés gratuitement. Si vous êtes un client actuel de

Cigna, veuillez appeler le numéro indiqué au verso de votre

carte d’identité. Sinon, veuillez appeler le numéro

1.800.244.6224 (ATS : composez le numéro 711).

Portuguese – ATENÇÃO: Tem ao seu dispor serviços de

assistência linguística, totalmente gratuitos. Para clientes

Cigna atuais, ligue para o número que se encontra no verso do

seu cartão de identificação. Caso contrário, ligue para

1.800.244.6224 (Dispositivos TTY: marque 711).

Polish – UWAGA: w celu skorzystania z dostępnej,

bezpłatnej pomocy językowej, obecni klienci firmy Cigna

mogą dzwonić pod numer podany na odwrocie karty

identyfikacyjnej. Wszystkie inne osoby prosimy o

skorzystanie z numeru 1 800 244 6224 (TTY: wybierz 711).

Japanese –

注意事項:日本語を話される場合、無料の言語支援サー

ビスをご利用いただけます。現在のCignaの

お客様は、IDカード裏面の電話番号まで、お電話にてご

myCigna.com

15

連絡ください。その他の方は、1.800.244.6224(TTY:

711)まで、お電話にてご連絡ください。

Italian – ATTENZIONE: Sono disponibili servizi di

assistenza linguistica gratuiti. Per i clienti Cigna attuali,

chiamare il numero sul retro della tessera di identificazione.

In caso contrario, chiamare il numero 1.800.244.6224 (utenti

TTY: chiamare il numero 711).

German – ACHTUNG: Die Leistungen der

Sprachunterstützung stehen Ihnen kostenlos zur Verfügung.

Wenn Sie gegenwärtiger Cigna-Kunde sind, rufen Sie bitte die

Nummer auf der Rückseite Ihrer Krankenversicherungskarte

an. Andernfalls rufen Sie 1.800.244.6224 an (TTY: Wählen

Sie 711).

HC-NOT97 07-17

Mental Health Parity and Addiction Equity Act of 2008

(MHPAEA) - Non-Quantitative Treatment Limitations

(NQTLs)

Federal MHPAEA regulations provide that a plan cannot

impose a Non-Quantitative Treatment Limitation (NQTL) on

mental health or substance use disorder (MH/SUD) benefits in

any classification unless the processes, strategies, evidentiary

standards, or other factors used in applying the NQTL to

MH/SUD benefits are comparable to, and are applied no more

stringently than, those used in applying the NQTL to

medical/surgical benefits in the same classification of benefits

as written and in operation under the terms of the plan.

Non-Quantitative Treatment Limitations (NQTLs) include:

Medical management standards limiting or excluding

benefits based on Medical Necessity or whether the

treatment is experimental or investigative;

Prescription drug formulary design;

Network admission standards;

Methods for determining in-network and out-of-network

provider reimbursement rates;

Step therapy a/k/a fail-first requirements; and

Exclusions and/or restrictions based on geographic location,

facility type or provider specialty.

A description of your plan’s NQTL methodologies and

processes applied to medical/surgical benefits and MH/SUD

benefits is available for review by accessing:

www.cigna.com\sp

To determine which document applies to your plan, select the

relevant health plan product; medical management model

(inpatient only or inpatient and outpatient) which can be

located in this booklet immediately following The Schedule;

and pharmacy coverage (whether or not your plan includes

pharmacy coverage).

C-NOT113 M 01-20m

How To File Your Claim

There’s no paperwork for In-Network care. Just show your

identification card and pay your share of the cost, if any; your

provider will submit a claim to Cigna for reimbursement. Out-

of-Network claims can be submitted by the provider if the

provider is able and willing to file on your behalf. If the

provider is not submitting on your behalf, you must send your

completed claim form and itemized bills to the claims address

listed on the claim form.

You may get the required claim forms from the website listed

on your identification card or by using the toll-free number on

your identification card.

CLAIM REMINDERS

BE SURE TO USE YOUR MEMBER ID AND

ACCOUNT/GROUP NUMBER WHEN YOU FILE

CIGNA’S CLAIM FORMS, OR WHEN YOU CALL

YOUR CIGNA CLAIM OFFICE.

YOUR MEMBER ID IS THE ID SHOWN ON YOUR

BENEFIT IDENTIFICATION CARD.

YOUR ACCOUNT/GROUP NUMBER IS SHOWN ON

YOUR BENEFIT IDENTIFICATION CARD.

BE SURE TO FOLLOW THE INSTRUCTIONS LISTED

ON THE BACK OF THE CLAIM FORM CAREFULLY

WHEN SUBMITTING A CLAIM TO CIGNA.

Timely Filing of Out-of-Network Claims

The Plan will consider claims for coverage under the Plan

when proof of loss (a claim) is submitted within 180 days for

Out-of-Network benefits after services are rendered. If

services are rendered on consecutive days, such as for a

Hospital Confinement, the limit will be counted from the last

date of service. If claims are not submitted within 180 days for

Out-of-Network benefits, the claim will not be considered

valid and will be denied.

myCigna.com

16

WARNING: Any person who knowingly and with intent to

defraud any insurance company or other person files an

application for insurance or statement of claim containing any

materially false information; or conceals for the purpose of

misleading, information concerning any material fact thereto,

commits a fraudulent insurance act.

HC-CLM25 01-11

V11 M

Eligibility - Effective Date

Employee Coverage

This Plan is offered to you as an Employee.

Eligibility for Employee Coverage

You are eligible to participate in the Plan if you are classified

by the Employer as a full-time employee that is regularly

scheduled to work at least 30 hours of service per week (an

“Employee”) and you complete the Plan’s waiting period (as

described below).

You are not an Employee that is eligible to participate in the

Plan if:

you are a leased employee;

you are an individual classified by the Employer as an

independent contractor, a leased employee, or an employee

of a non-participating affiliate, whether or not you are an

actual employee of the Employer

you are a union employee, unless otherwise required by a

collective bargaining agreement;

you are a nonresident alien that does not receive U.S. source

income; or

you are covered by a welfare plan maintained by a foreign

affiliate.

Waiting Period

As an eligible Employee, you may begin participating in the

Plan on the first of the month following 60 days of

employment as an eligible Employee as defined above.

If you are laid off and are called back within six months of

your layoff date, your benefits are reinstated as they were prior

to your layoff. The waiting period is waived. If you are laid

off and then called back more than six months after your

layoff date, you will be need to complete the Plan’s waiting

period again before you are eligible for Plan benefits.

If you leave voluntarily and have a break in service that is 13

weeks or longer, you are considered “rehired” and your

benefits are applied as any other new hire (i.e. the waiting

period applies). If you leave voluntarily and have a break in

service that is less than 13 weeks, you will be immediately

eligible for the Plan without being subject to the Plan’s

waiting period.

If you cease to be an eligible Employee for reasons other than

termination of employment and then return to eligible

Employee status, your prior service as an Employee will count

toward the Plan’s waiting period, regardless of whether you

return to eligible Employee status within 13 weeks.

Effective Date of Employee Coverage

You will become covered by the Plan on the date you satisfy

the Plan’s waiting period if you elect coverage under the Plan

through Mohawk’s online enrollment system or by calling

Mohawk’s Benefit Service Center at 1-866-481-4922 within

30 days of becoming eligible to participate in the Plan. You

will not be denied enrollment due to your health status.

You will become covered by the Plan on your first day of

eligibility, following your election, if you are in Active

Service on that date, or if you are not in Active Service on that

date due to your health status.

To begin participating in the Plan, you must enroll in the Plan

by following the instructions in your enrollment materials

within 30 days of the date you complete the Plan’s waiting

period (this 30-day period is referred to as your “initial

enrollment period”). You will not be enrolled in the Plan if

you do not enroll within 30 days of the date you become

eligible, unless you qualify under the section of this booklet

entitled "Special Enrollment Rights Under the Health

Insurance Portability & Accountability Act (HIPAA)" or

experience another qualified change event (as described in the

section of this booklet entitled “Effect of Section 125 Tax

Regulations on This Plan”) and timely enroll in the Plan, or

unless you enroll during the Plan’s next open enrollment

period.

The benefit choices you make during your initial enrollment

period will remain in effect for the remainder of the plan year,

unless you qualify for a special enrollment period or you

experience a qualified change event (as described later in this

booklet) and you make new benefit elections.

Special Eligibility Rules

The Plan Administrator may establish different eligibility

requirements (for example, waiving the Waiting Period or

recognizing prior service) with respect to Employees who

become employed by the Employer as a result of a corporate

transaction.

myCigna.com

17

Dependent Coverage

For your Dependents to be covered by the Plan, you will have

to timely enroll your Dependents, provide proof of Dependent

status to the Plan, and pay the required contribution toward the

cost of Dependent coverage.

Eligible Dependents

Dependent for purposes of the Plan means:

• An Employee’s spouse, meaning the one individual with

whom the Employee has established a valid marriage

according to state law, including a common law marriage. A

divorced former spouse of an Employee is not an eligible

Dependent.

Please Note: If your spouse is eligible for benefits through

another employer and you elect coverage for him or her

under the Plan, you will pay an additional amount (as

outlined in the Plan’s enrollment materials) for the spouse’s

coverage. An eligible Employee currently married to

another eligible Employee can remain on the Plan without

the spousal surcharge.

• An Employee’s child who is less than 26 years of age.

Coverage of a Dependent child will continue until the end of

the calendar month in which the child turns age 26.

• An Employee’s child, regardless of age, who (i) is

unmarried and primarily supported by the Employee; (ii)

was continuously covered under the Plan as a Dependent

prior to attaining age 26; and (iii) is incapable of sustaining

his or her own living by reason of a mental or physical

disability. The child must have been mentally or physically

incapable of earning his or her own living due to the

disabling condition prior to attaining age 26. Written proof

of incapacity and dependency satisfactory to the Plan must

be furnished and approved by the Plan within 31 days after

the date the child reaches age 26. The Plan may require, at

reasonable intervals, subsequent proof satisfactory to the

Plan of the child’s continuing disability.

“Child” for purposes of the Plan means an Employee’s natural

child, stepchild, legally adopted child, foster child, or any

other child for whom the Employee has been named legal

guardian. The term “child” will also include an Employee’s

grandchild who is considered the Employee’s dependent for

federal income tax purposes. For purposes of this definition, a

legally adopted child shall include a child placed in an

Employee’s physical custody in anticipation of adoption.

“Child” shall also mean a covered Employee’s child who is an

Alternate Recipient under a Qualified Medical Child Support

Order, as required by the Federal Omnibus Budget

Reconciliation Act of 1993.

Residents of a country other than the United States are not

eligible for Dependent coverage under the Plan.

To establish a Dependent relationship, the Plan reserves the

right to require documentation satisfactory to the Plan

Administrator.

An individual may be enrolled in the Plan as an Employee or a

Dependent, but not both. No one may be considered as a

Dependent of more than one Employee.

Effective Date of Dependent Coverage

Insurance for your Dependents will become effective on the

date you complete the Plan’s waiting period, if you timely

elect Dependent coverage during your initial enrollment

period in the manner outlined in the Plan’s enrollment

materials..

Your Dependents will be covered only if you are enrolled in

the Plan.

If you do not enroll your eligible Dependents during your

initial enrollment period, you will not be able to enroll them in

the Plan until the next open enrollment period, unless you

qualify for a special enrollment period or you experience

another qualified change event (as described later in this

booklet) and you make new benefit elections.

Exception for Newborns

Any Dependent child born while you are enrolled in the Plan

will become covered by the Plan on the date of his birth if you

elect Dependent coverage no later than 31 days after his birth.

If you do not elect to insure your newborn child within such

31 days, no benefits for expenses incurred will be payable for

that child.

HC-ELG274 M 01-19

Important Information About Your

Medical Plan

Details of your medical benefits are described on the

following pages.

Opportunity to Select a Primary Care Physician

Choice of Primary Care Physician:

This Plan does not require that you select a Primary Care

Physician or obtain a referral from a Primary Care Physician

in order to receive all benefits available to you under this Plan.

However, a Primary Care Physician may serve an important

role in meeting your health care needs by providing or

arranging for medical care for you and your Dependents. For

this reason, we encourage the use of Primary Care Physicians

and provide you with the opportunity to select a Primary Care

Physician from a list provided by Cigna for yourself and your

Dependents. If you choose to select a Primary Care Physician,

the Primary Care Physician you select for yourself may be

myCigna.com

18

different from the Primary Care Physician you select for each

of your Dependents.

Changing Primary Care Physicians:

You may request a transfer from one Primary Care Physician

to another by contacting us at the member services number on

your ID card. Any such transfer will be effective on the first

day of the month following the month in which the processing

of the change request is completed.

In addition, if at any time a Primary Care Physician ceases to

be a Participating Provider, you or your Dependent will be

notified for the purpose of selecting a new Primary Care

Physician.

HC-IMP212 M 01-18

myCigna.com

19

LocalPlus My Medical Neighborhood Medical Benefits

The Schedule

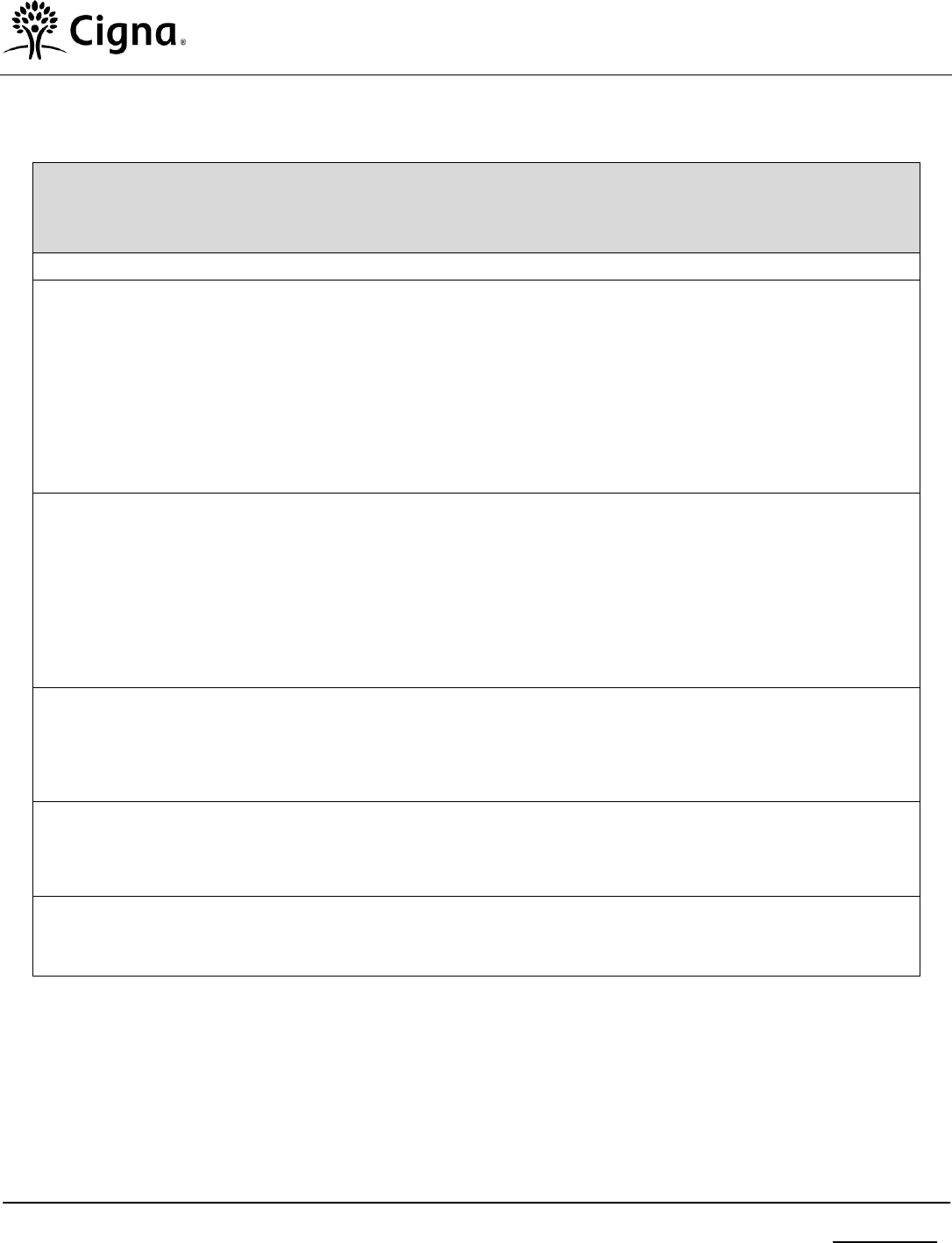

For You and Your Dependents

The Plan provides coverage for care In-Network and Out-of-Network. To receive Plan benefits, you and your Dependents

may be required to pay a portion of the Covered Expenses for services and supplies. That portion is the Copayment,

Deductible or Coinsurance.

When you receive services from an In-Network Provider, remind your provider to utilize In-Network Providers for x-rays,

lab tests and other services to ensure the cost may be considered at the In-Network level.

If you are unable to locate an In-Network Provider in your area who can provide you with a service or supply that is

covered under this Plan, you must call the number on the back of your I.D. card to obtain authorization for Out-of-

Network Provider coverage. If you obtain authorization for services provided by an Out-of-Network Provider, benefits for

those services will be covered at the In-Network benefit level.

.

Coinsurance

The term Coinsurance means the percentage of charges for Covered Expenses that an insured person is required to pay

under the Plan.

Copayments/Deductibles

Copayments are expenses to be paid by you or your Dependent for covered services. Deductibles are also expenses to be

paid by you or your Dependent. Deductible amounts are separate from and not reduced by Copayments. Copayments and

Deductibles are in addition to any Coinsurance. Once the Deductible maximum in The Schedule has been reached, you

and your family need not satisfy any further medical deductible for the rest of that year.

Out-of-Pocket Expenses - For In-Network Charges Only

Out-of-Pocket Expenses for In-Network charges are Covered Expenses incurred for charges that are not paid by the Plan

because of any Deductibles, Copayments or Coinsurance. Such Covered Expenses accumulate to the the In-Network Out-

of-Pocket Maximum shown in The Schedule. When the In-Network Out-of-Pocket Maximum is reached, all In-Network

Covered Expenses, except charges for non-compliance penalties, are payable by the Plan at 100%.

Accumulation of Plan Deductibles and Out-of-Pocket Maximums

Deductibles and Out-of-Pocket Maximums do not cross-accumulate (that is, In-Network will accumulate to In-Network

and Out-of-Network will accumulate to Out-of-Network). All other Plan maximums and service-specific maximums

(dollar and occurrence) cross-accumulate between In- and Out-of-Network unless otherwise noted.

Multiple Surgical Reduction

Multiple surgeries performed during one operating session result in payment reduction of 50% to the surgery of lesser

charge. The most expensive procedure is paid as any other surgery.

myCigna.com

20

LocalPlus My Medical Neighborhood Medical Benefits

The Schedule

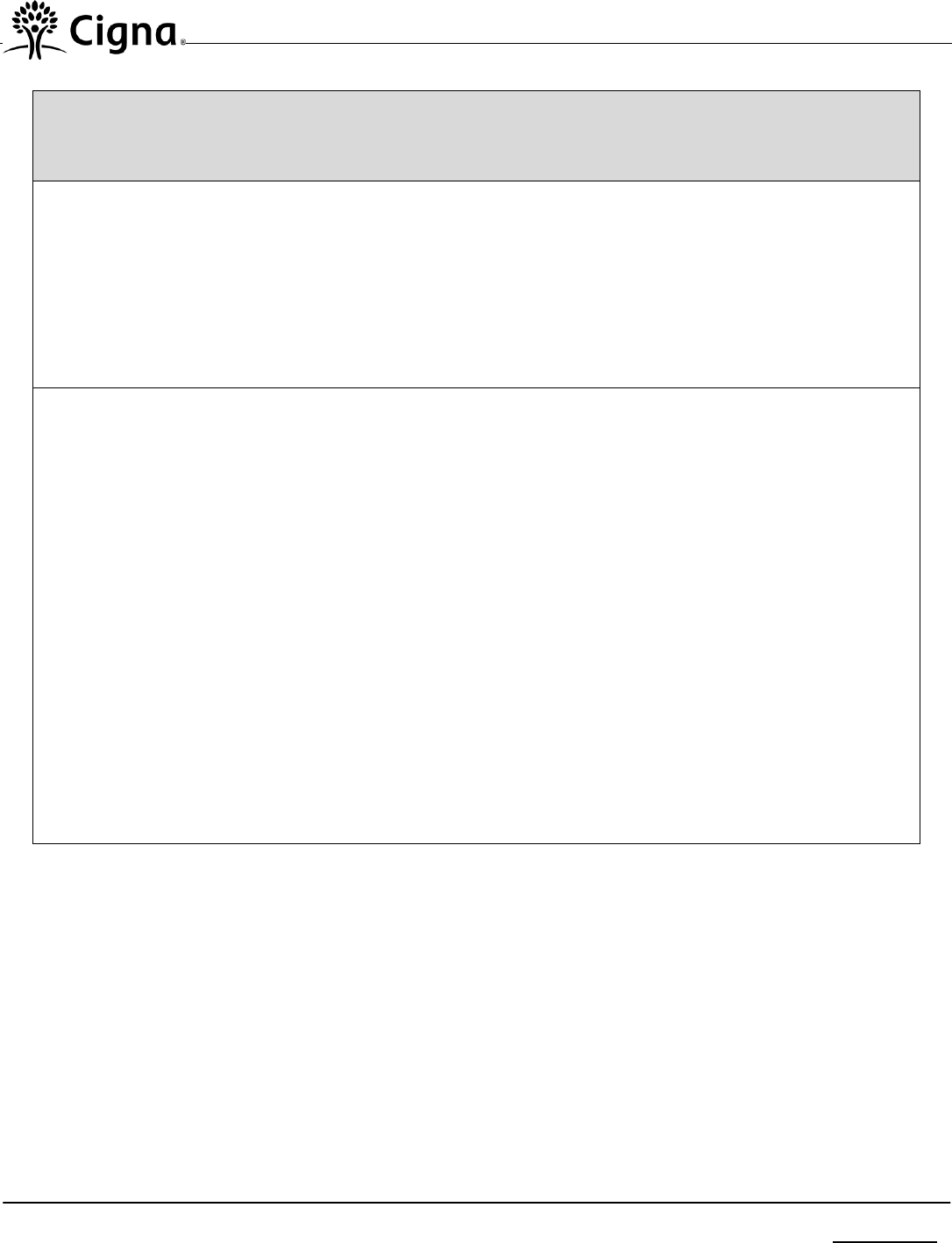

Assistant Surgeon and Co-Surgeon Charges

Assistant Surgeon

The maximum amount payable will be limited to charges made by an assistant surgeon that do not exceed a percentage of

the surgeon’s allowable charge as specified in Cigna Reimbursement Policies. (For purposes of this limitation, allowable

charge means the amount payable to the surgeon prior to any reductions due to coinsurance or deductible amounts.)

Co-Surgeon

The maximum amount payable for charges made by co-surgeons will be limited to the amount specified in Cigna

Reimbursement Policies.

Out-of-Network Charges for Certain Services

Charges for services furnished by an Out-of-Network provider in an In-Network hospital or ambulatory surgical center

while you are receiving In-Network services at that In-Network facility: (i) are payable at the In-Network cost-sharing

level; and (ii) the cost-sharing payments that you pay to the Out-of-Network provider will count toward the Plan’s In-

Network Deductible and Out-of-Pocket Maximum. Your cost-sharing requirements for these Out-of-Network services will

be determined based on the lesser of (i) the median amount negotiated by the Plan with In-Network providers for the

services in the geographic area where the services are provided, or (ii) the amount billed by the provider.

The member is only responsible for applicable In-Network cost-sharing amounts (any deductible, copay or coinsurance),

determined as described above. The member is not responsible for any charges that may be made in excess of these

amounts, and the Out-of-Network provider is not permitted to balance bill you for these amounts. If the Out-of-Network

provider bills you for an amount higher than the amount you owe as indicated on the Explanation of Benefits (EOB),

contact Cigna Customer Service at the phone number on your ID card.

Please Note: The Plan is not required to apply the special cost-sharing rules above if you provide specific informed

consent, as provided by law, to treatment by the Out-of-Network provider. In this case, the Out-of-Network provider is

also not prohibited from balance billing you for any amounts not paid by the Plan. This consent exception does not apply

to “ancillary services” or to items or services furnished as a result of unforeseen, urgent medical needs arising at the time

an item or service is provided. “Ancillary services” for this purpose are (i) items and services related to emergency

medicine, anesthesiology, pathology, radiology, and neonatology, whether provided by a physician or non-physician

practitioner; (ii) items and services provided by assistant surgeons, hospitalists, and intensivists; (iii) diagnostic services

(including radiology and laboratory services); and (iv) items and services provided by an Out-of-Network provider if there

is no In-Network provider who can furnish such item or service at the facility.

myCigna.com

21

LocalPlus My Medical Neighborhood Medical Benefits

The Schedule

Out-of-Network Emergency Services Charges

1. Emergency Services are covered, without the need for any prior authorization, at the In-Network cost-sharing level if

services are received from a non-Participating (Out-of-Network) provider or facility.

2. The cost-sharing payments that you pay to the Out-of-Network provider or facility for Emergency Services will count

toward the Plan’s In-Network Deductible and Out-of-Pocket Maximum.

3. Your cost-sharing requirements for Emergency Services furnished by an Out-of-Network provider or facility will be

determined based on the lesser of the median amount negotiated by the Plan with In-Network providers or facilities for

the services in the geographic area where the Emergency Services are provided, or (ii) the amount billed by the

provider or facility.

4. The Plan will not impose any administrative requirement or coverage limitation for Emergency Services furnished by

an Out-of-Network provider or facility that are more restrictive than the requirements or limitations that apply to

Emergency Services received from an In-Network provider or facility.

The member is only responsible for applicable In-Network cost-sharing amounts (any deductible, copay or coinsurance),

determined as described above. The member is not responsible for any charges that may be made in excess of these

amounts, and the Out-of-Network provider or facility is not permitted to balance bill you for these amounts. If the Out-of-

Network provider or facility bills you for an amount higher than the amount you owe as indicated on the Explanation of

Benefits (EOB), contact Cigna Customer Service at the phone number on your ID card.

Charges for Air Ambulance Services

Charges for Air Ambulance Services: (i) are payable at the In-Network cost-sharing level, regardless of the provider’s

network status; and (ii) the cost-sharing payments that you pay to any Out-of-Network provider for Air Ambulance

Services will count toward the Plan’s In-Network Deductible and Out-of-Pocket Maximum. Your cost-sharing

requirements for Out-of-Network Air Ambulance Services will be determined based on the lesser of (i) the median

amount negotiated by the Plan with In-Network providers for the services in the geographic area where the services are

provided, or (ii) the amount billed by the provider.

The member is only responsible for applicable In-Network cost-sharing amounts (any deductible, copay or coinsurance),

determined as described above. The member is not responsible for any charges that may be made in excess of the these

amounts, and the Out-of-Network provider is not permitted to balance bill you for these amounts. If the Out-of-Network

provider bills you for an amount higher than the amount you owe as indicated on the Explanation of Benefits (EOB),

contact Cigna Customer Service at the phone number on your ID card.

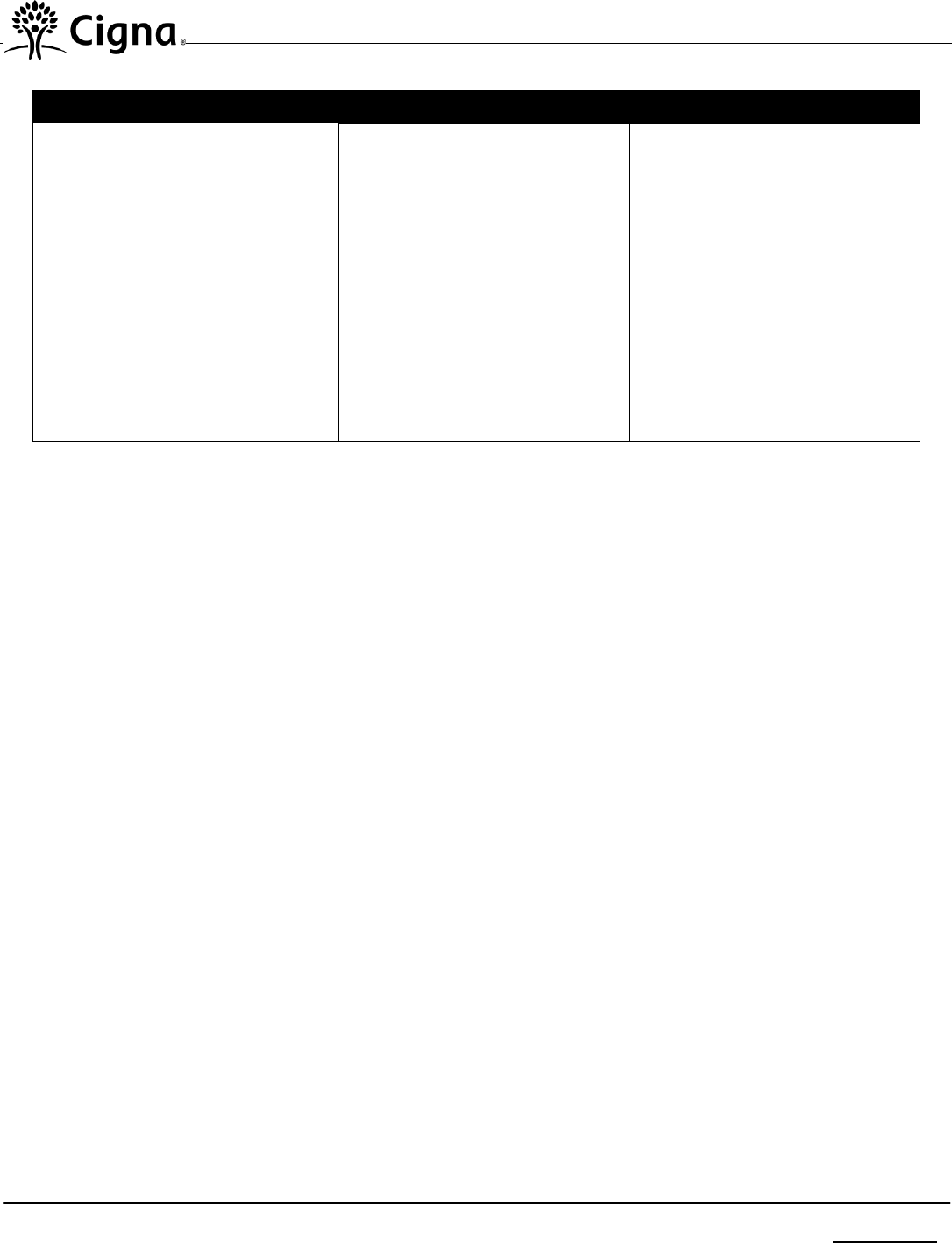

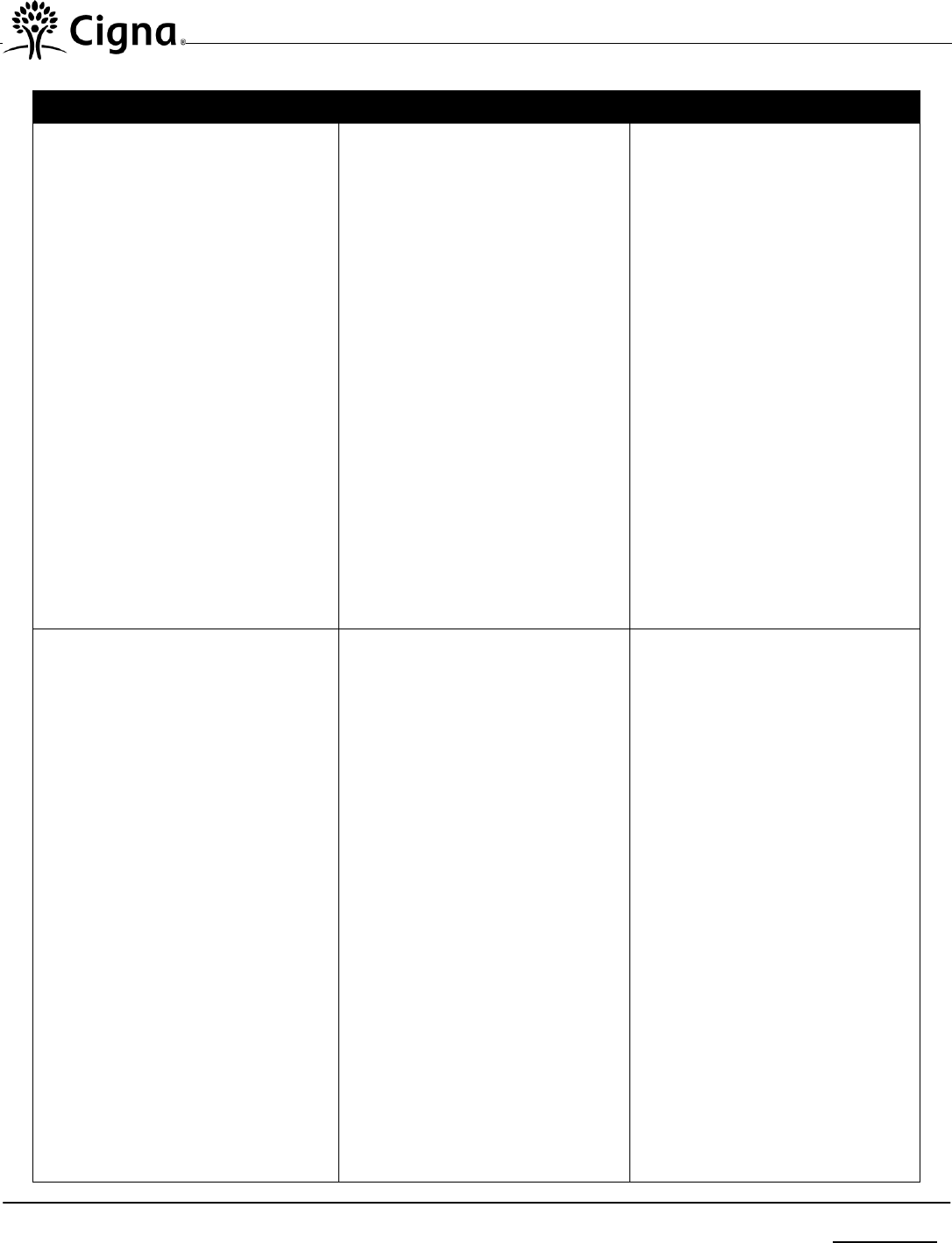

BENEFIT HIGHLIGHTS

IN-NETWORK

OUT-OF-NETWORK

Lifetime Maximum

Unlimited

The Percentage of Covered Expenses

the Plan Pays

80%

50% of the Maximum Reimbursable

Charge

myCigna.com

22

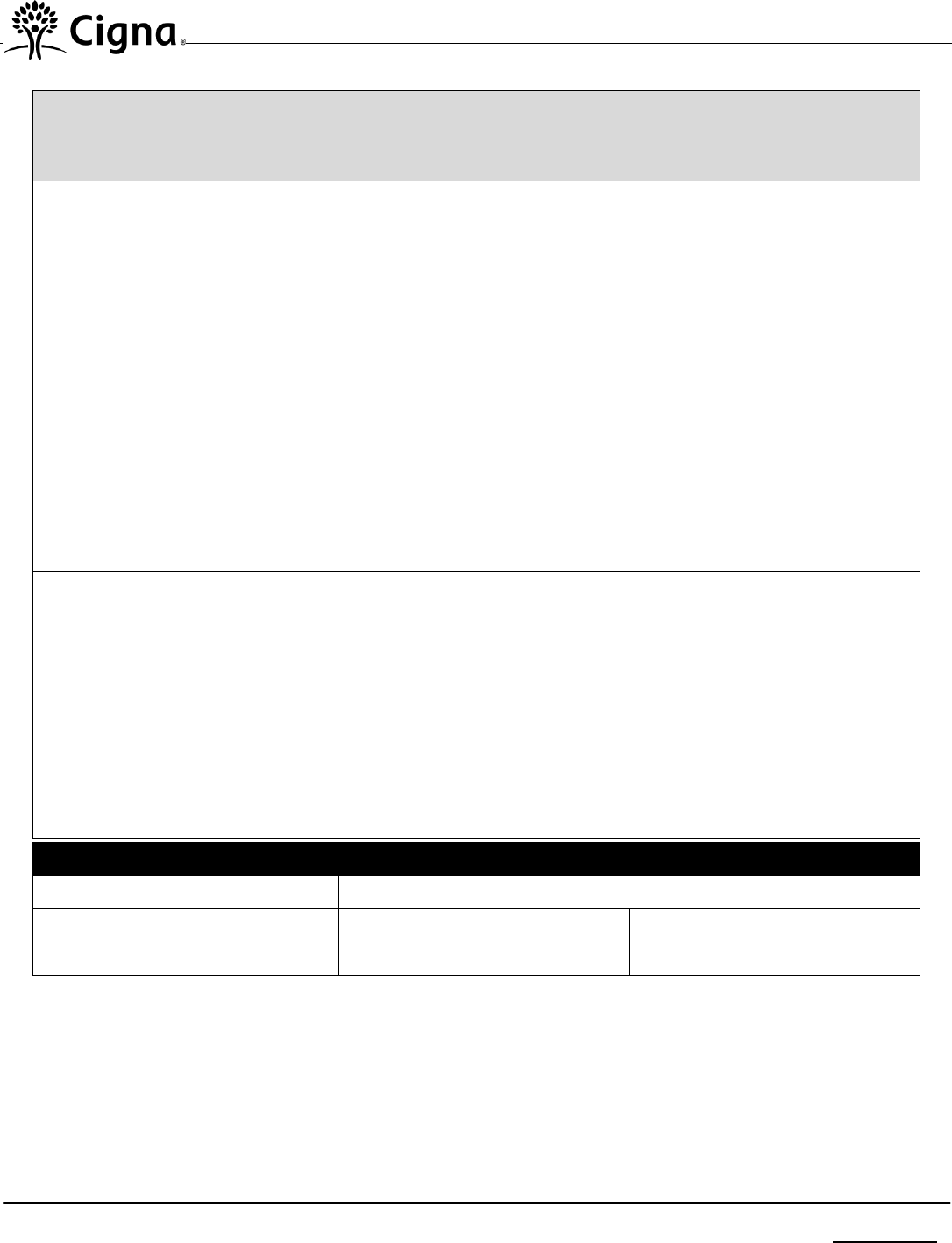

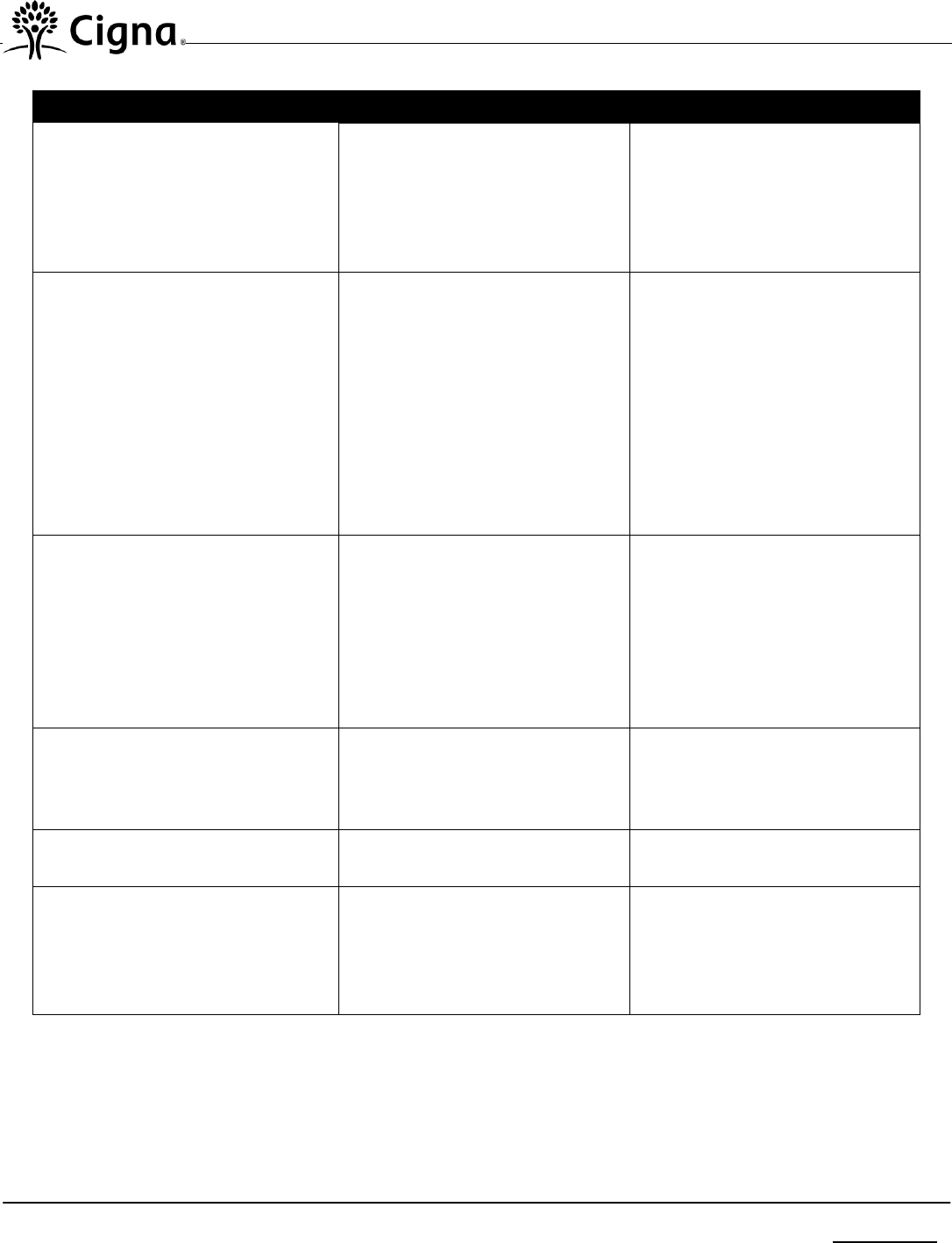

BENEFIT HIGHLIGHTS

IN-NETWORK

OUT-OF-NETWORK

Maximum Reimbursable Charge

The Maximum Reimbursable Charge

for Out-of-Network services, other than

those described in the Schedule

sections “Out-of-Network Charges for

Certain Services,” “Out-of-Network

Emergency Services Charges,” and

“Charges for Air Ambulance Services”

above, is determined based on the

lesser of (i) the provider's normal

charge for a similar service or supply;

or (ii) the amount agreed to by the Out-

of-Network provider and Cigna, or (iii)

an Employer-selected percentage of a

fee schedule Cigna has developed that

is based upon a methodology similar to

a methodology utilized by Medicare to

determine the allowable fee for the

same or similar services within the

geographic market.

In some cases, a Medicare based

schedule will not be used and the

Maximum Reimbursable Charge for

covered services is determined based

on the lesser of:

the provider’s normal charge for a

similar service or supply; or

the amount agreed to by the Out-of-

Network provider and Cigna; or

the 80th percentile of charges made

by providers of such service or

supply in the geographic area where

it is received as compiled in a

database selected by Cigna.

Not Applicable

110%

myCigna.com

23

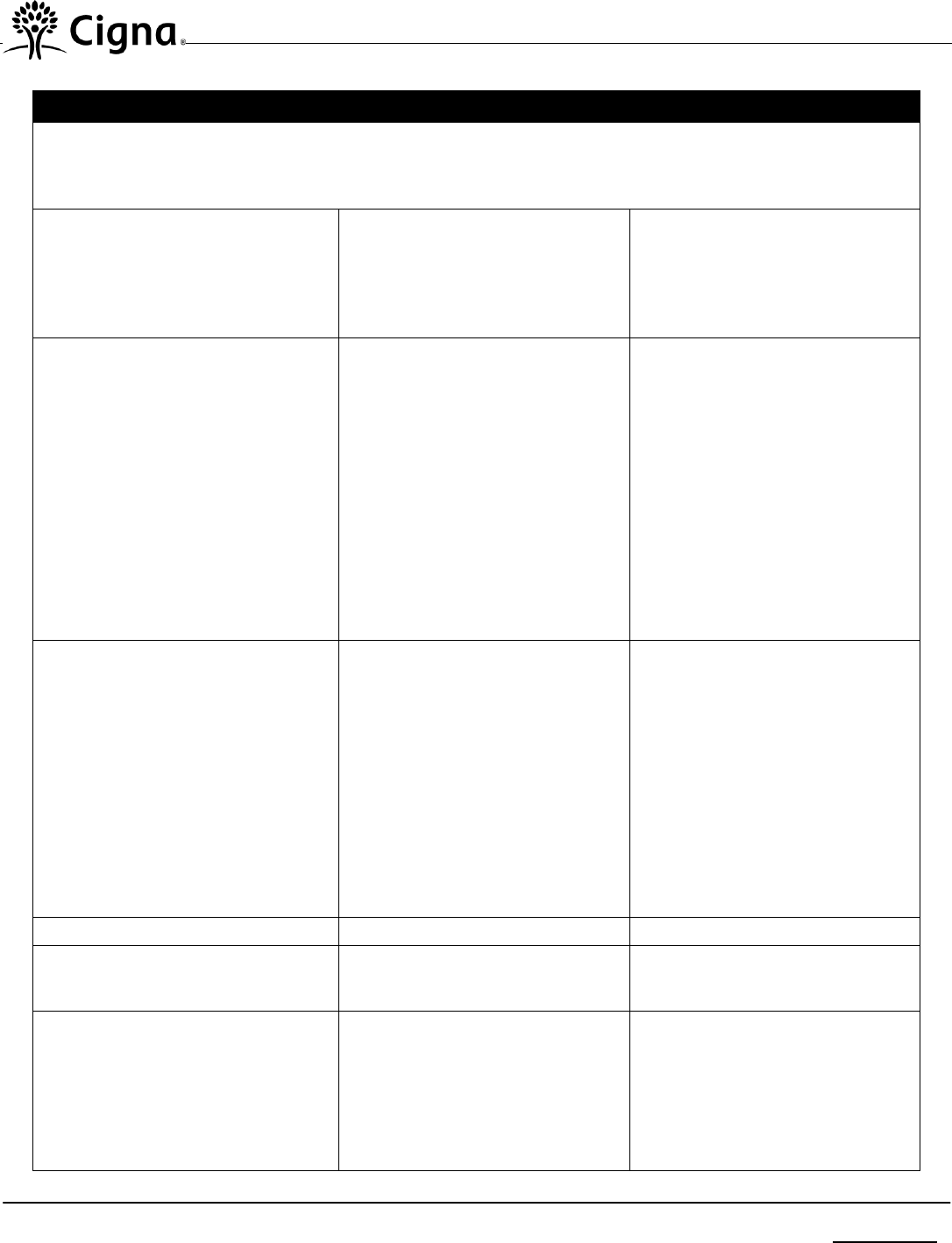

BENEFIT HIGHLIGHTS

IN-NETWORK

OUT-OF-NETWORK

Note:

The provider may bill you for the

difference between the provider’s

normal charge and the Maximum

Reimbursable Charge, in addition to

applicable copayment, deductibles

and/or coinsurance.

Note:

Some providers forgive or waive the

cost share obligation (e.g. your

deductible and/or coinsurance) that this

Plan requires you to pay. Waiver of

your required cost share obligation can

jeopardize your coverage under this

Plan. For more details, see the

Exclusions Section.

Calendar Year Deductible

Individual

$1,000 per person

$3,300 per person

Family Maximum

$2,500 per family

$6,600 per family

Family Maximum Calculation

Individual Calculation:

Family members meet only their

individual deductible and then their

claims will be covered under the plan

coinsurance; if the family deductible

has been met prior to their individual

deductible being met, their claims

will be paid at the plan coinsurance.

Out-of-Pocket Maximum

Individual

$5,000 per person

Unlimited

Family Maximum

$13,000 per family

Unlimited

Family Maximum Calculation

Individual Calculation:

Family members meet only their

individual Out-of-Pocket and then

their claims will be covered at 100%;

if the family Out-of-Pocket has been

met prior to their individual Out-of-

Pocket being met, their claims will

be paid at 100%.

myCigna.com

24

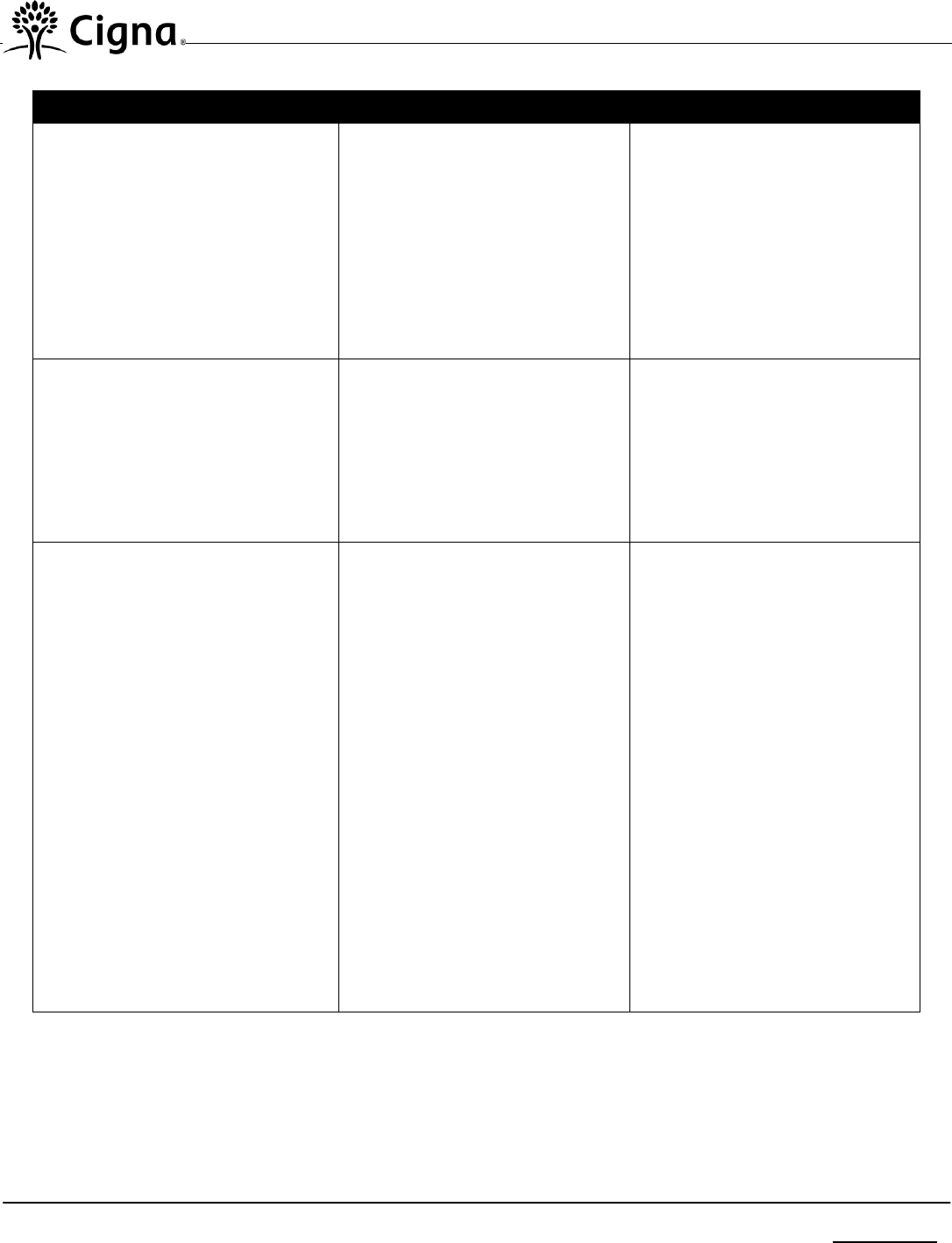

BENEFIT HIGHLIGHTS

IN-NETWORK

OUT-OF-NETWORK

Physician’s Services

Primary Care Physician’s Office

Visit

$35 per visit copay, then 100%

Plan deductible, then 50% of the

Maximum Reimbursable Charge

Specialty Care Physician’s Office

Visit

Consultant and Referral

Physician’s Services

$35 per visit copay, then 100%

Plan deductible, then 50% of the

Maximum Reimbursable Charge

Note:

OB/GYN providers will be

considered either as a PCP or

Specialist, depending on how

the provider contracts with

Cigna on an In-Network basis.

Out-of-Network OB/GYN

providers will be considered a

Specialist.

Surgery Performed in the Physician’s

Office

Primary Care Physician

Plan deductible, then 80%

Plan deductible, then 50% of the

Maximum Reimbursable Charge

Specialty Care Physician

Plan deductible, then 80%

Plan deductible, then 50% of the

Maximum Reimbursable Charge

Second Opinion Consultations

(provided on a voluntary basis)

Primary Care Physician’s Office

Visit